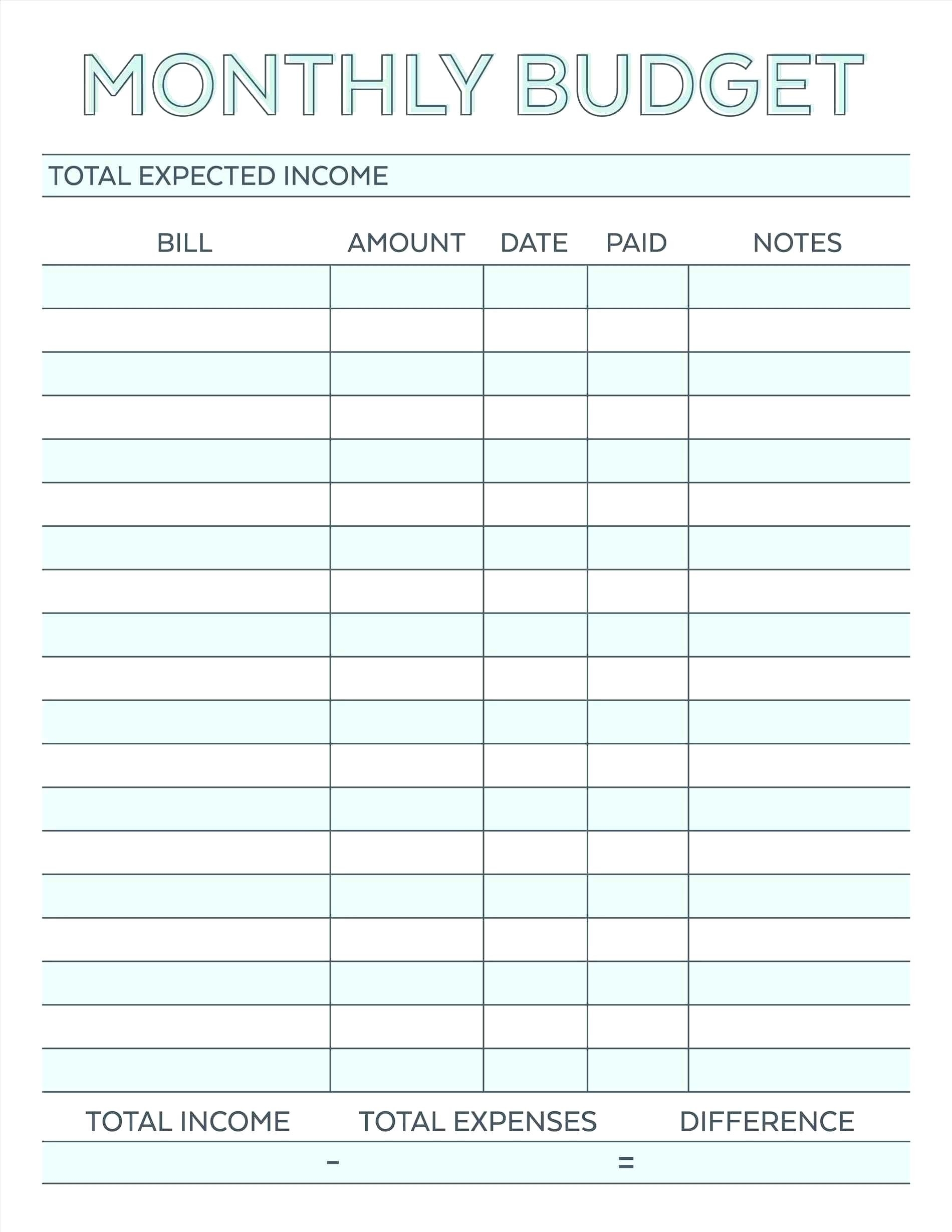

A spreadsheet is perfect when you have one checking account and a couple of credit cards. I really like the spreadsheet method and I think everyone should use it when they are starting out. If it’s all automatic, you won’t have to recall what you spent $17 on at Target. This is a good thing when you first start tracking your expense. This can take a little time, but the act of typing things in forces me to remember what we spent our money on throughout the month. I manually go through our checking account and credit cards and enter each line item on the spreadsheet. It will be tedious to get the spreadsheet setup just the way you like it, but after a few months, it will be a piece of cake because you’ll already have the template from the previous month. I put each expense category in the column and an expense line item in the row.

TRACK MONTHLY EXPENSES FREE

I used Excel, but if you don’t have it, then you can use a free spreadsheet like Google spreadsheet. When I first started, I went with the old school method of tracking everything on a spreadsheet. You never want to spend more money than you make and you’ll be able to see that at the end of every month if you track your cash flow. We can see where we spend our money and it keeps us on track. I have been tracking our monthly expenses in detail for a few years now and it has been really helpful.

TRACK MONTHLY EXPENSES FOR FREE

How about getting your shows for free from the library instead? That way you don’t even have to wait a week to see the next episode of Game of Thrones. You’ll miss out on the 7% compound interest and that’s what’s really painful.

Is the HBO subscription worth $25,000 in retirement saving? That’s what it will cost you at $20/month for 30 years. Once you know what you are spending money on, then you can see if any of those things are really higher priorities than financial security. Do you know how much you spend on eating out, groceries, coffee, clothing, apps, cable TV, and magazine subscriptions every month? Keeping track of your spending will help shed light on your spending habits.

Well, they have some idea, but they lose track of how much they really spent. Most people have no idea where their money goes. You need to be able to save first so you’ll have money to invest. It’s essential to track your expense so you know what you are spending money on. The first step to retirement investing is actually quite simple, but it can be a lot of work if you haven’t done it before. Let’s take a step back and start at the beginning. I don’t know how my mom did it with 3 boys. I’ll have to write it a piece at a time and then put it together later. One of these days, I’d like to put together an early retirement guide, but I just don’t have time to write the whole thing at once.

0 kommentar(er)

0 kommentar(er)